This week we're covering:

- 📺 Netflix Users Discover Ads Aren't That Bad, Actually

- ⚾ 26 Million Reasons Fox Is Smiling About World Series Game 7

- 🎬 Creative Spotlight: Home Instead: “Home But Not Alone”

- 🍻 Heinken’s Group Chat Bar: Touch Grass, Drink Beer

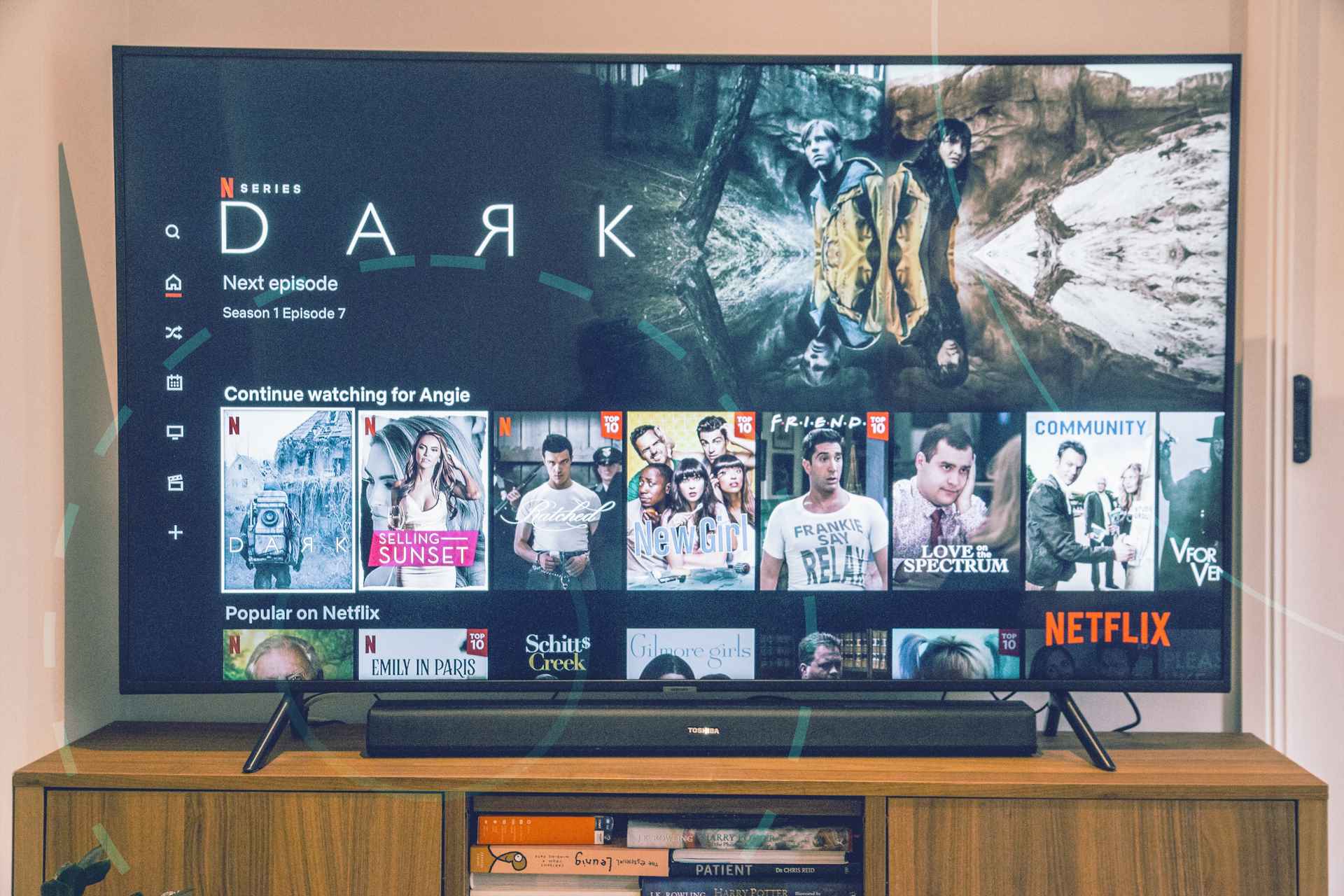

Netflix's Ad Tier Hits Critical Mass

Nearly half of all Netflix viewing now happens on its ad-supported tier, a milestone that marks the streaming giant's full arrival as an advertising platform and reshapes the economics of premium video.

According to Comscore's latest State of Streaming report, 45% of Netflix viewing occurred on the ad tier in August 2025, up from 34% just one year earlier. That 11% jump shows Netflix has cracked the code on converting subscribers without losing premium customers.

The ad tier acceleration

Netflix isn't alone. Disney+ saw ad-tier viewing climb 16% year-over-year, while Prime Video and HBO Max each added about 10%. Consumers are trading away ad-free experiences for lower subscription costs, and streamers are gaining a second revenue stream.

YouTube, long the undisputed leader in ad-supported streaming, actually slipped 2%. It still commands more than half of all ad-supported time, but Netflix's momentum makes it worth asking whether it will eat into YouTube's dominance or simply expand the total pie.

What’s driving adoption

Price sensitivity is the obvious catalyst, but Comscore's research points to something deeper: Consumers are becoming more receptive to new ad formats, especially interactive and shoppable units that feel native to streaming rather than borrowed from linear TV.

That openness gives platforms room to innovate beyond the standard 15- and 30-second spots that defined television for decades. Netflix has been testing interactive formats and tighter integrations with its recommendation engine, turning ads into content discovery rather than blatant interruptions.

The bigger picture

Netflix's ad tier now reaches more than 300 million US households. That scale, combined with Netflix's first-party data and premium content library, makes it a direct competitor not just to linear TV but to Meta and Google in the fight for brand budgets.

Streaming platforms pulled in $3.8 billion in ad revenue in Q3 2025, up nearly 18%, while national linear TV fell 10% to $4.65 billion (excluding Olympics). The gap is closing fast, and Netflix's market sweep is a big reason why.

What this means for advertisers

Netflix's ad tier momentum proves that premium streaming inventory can deliver both reach and performance at scale. For performance marketers, Netflix's scale means premium inventory is no longer just for brand campaigns; it's becoming a viable channel for direct response and outcome-based buying.

The challenge now is building creatives that take full advantage of streaming's interactive capabilities rather than simply porting over linear spots.

Read More:

TV Industry Updates

- Fox hit a home run: Game 7 of the World Series drew nearly 26 million viewers, the most-watched since 2017.

- Local went programmatic: Dentsu and ITN/Magnite launched the first local linear TV private marketplace, rolling out in Q1 2026.

- Roku crossed $1 billion: Platform revenue hit $1.06 billion in Q3, up 17% YoY, with 90% of Ads Manager users new to Roku.

- Tubi turned profitable: Fox's AVOD streamer achieved profitability for the first time, with revenue up 27%.

- Streaming neared parity: Streaming ad revenue grew 18% to $3.8 billion in Q3 while linear fell 10% to $4.65 billion.

- CTV sought proof: IAB issued a conversion API guide to standardize CTV measurement and ROI tracking.

Creative Spotlight: Home Instead: "Home But Not Alone"

Home Instead's "Home But Not Alone" campaign brought Macaulay Culkin back as an adult Kevin McCallister, turning a 35-year-old Christmas classic into a festive reminder that, eventually, love needs backup.

The Details:

-

The 60-second spot is set to air during Home Alone broadcasts and college football coverage through January 11, putting the message in front of families during the exact moments when caregiving needs become obvious.

-

Culkin sealing his mom's house in plastic wrap worked as both a sight gag and a metaphor for the absurd lengths adult children go to when avoiding the actual care conversation.

-

Old Man Marley's granddaughter showed up with his shovel, carrying forward the lesson that isolation is the real danger, not the conversation itself.

What We Loved: FCB Chicago and director Jody Hill turned a nostalgia play into something that actually earned its emotional weight, proving you can sell in-home care without making people feel guilty or sad about it.

Marketing Mix

- Heineken went offline: Heineken turned a Knicks player's group chat into a real bar night, championing offline connection.

- Prebid reversed course: Prebid reversed its transaction ID policy after industry pushback, now lets publishers decide how IDs are shared.

- Gatorade flips the script: PepsiCo reworked its 1987 campaign, “No Ordinary Thirst Quencher,” complete with retro-styled Citrus Cooler bottles.

- Amazon's DSP leveled up: Amazon declared its DSP "fully featured" as ad revenue soared 24% to $17.7 billion in Q3.

- MLS courts viewers: Issa Rae starred in MLS's "All for the Cup" campaign, using celebrity power to boost postseason viewership.

- AI shopping surge: Amazon's Rufus assistant hit 250 million users, making shoppers 60% more likely to complete a purchase.

✨📩 Cut through the noise of endless media coverage. Subscribe to The tvRoom for a curated weekly digest of only the insights that truly impact your work in TV and streaming.